Financial Analysis for Businesses

Get Your Quick and Easy Financial Analysis

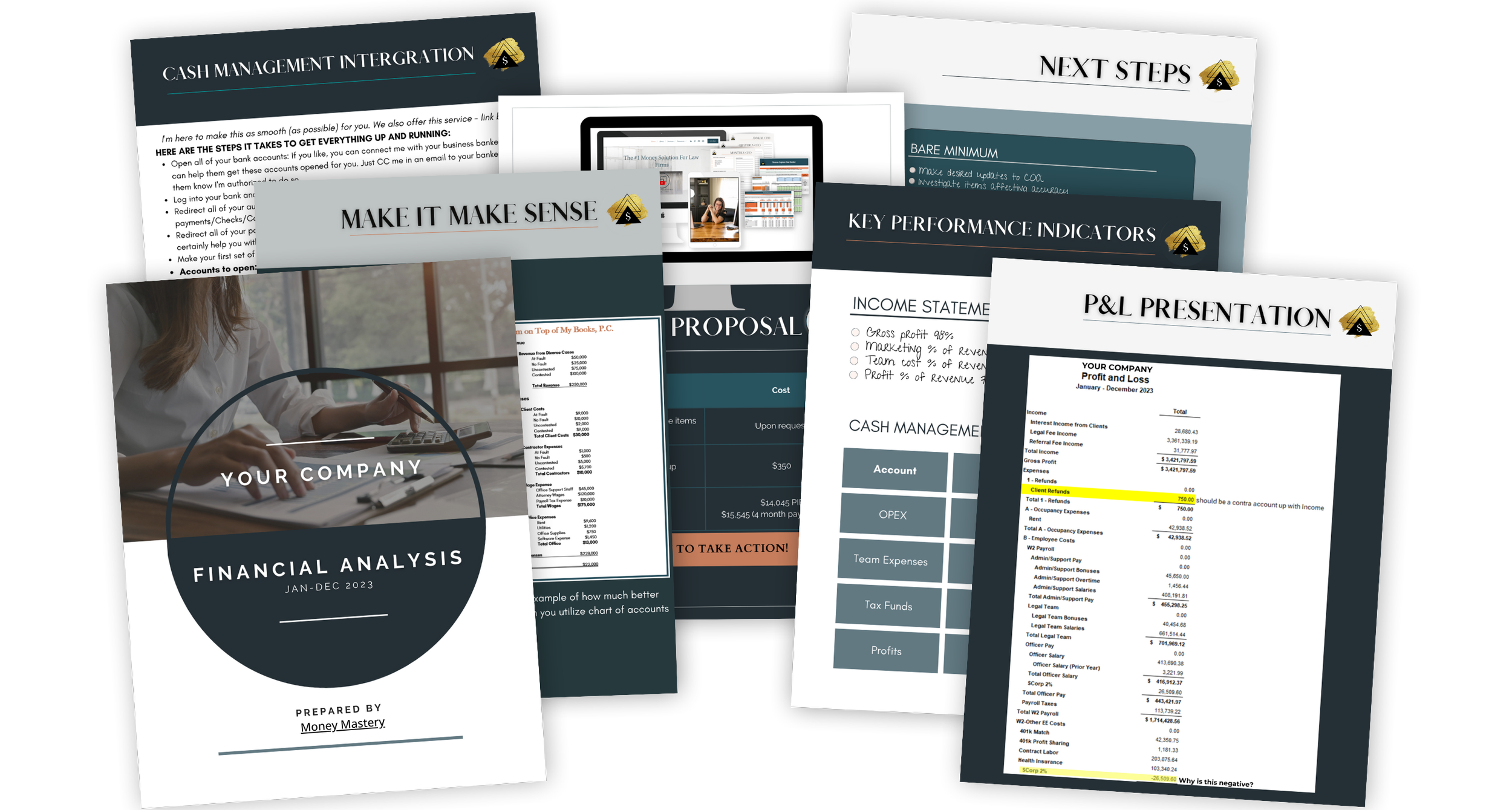

Struggling to Navigate Your Business's Finances? We Can Help You Gain Clarity and Confidence in Your Financials with Our Quick and Painless Financial Analysis.

If you’re unsure that your financial systems are intact, our Financial Analysis is the solution you've been searching for. Gain insight into your business’s financial health, identify areas for improvement, and unlock strategies for maximizing profitability. Don't let financial uncertainty hold your business back – take control today.

If your questioning the accuracy of your financials take is a layer deeper with our In-Depth review so we can tell you with complete certainty how well your books are kept up with.

Free

If you are a business owner who is confident that your books are timely and accurate, our free analysis is for you.

Here's what we'll do for you:

-

By optimizing your chart of accounts and enhancing individual account descriptions, we'll ensure your financial reports are user-friendly. We'll show your bookkeeper or accountant how to transform your financial reports into visually organized, easy-to-follow documents. We'll even create a video to guide them in making the necessary adjustments.

-

These are the needle movers in your firm’s business and how you keep track of your progress without getting lost in the weeds. We'll identify and explain relevant KPIs in your financial reports and discuss other critical indicators that impact your financial standing. With our guidance, you'll not only understand what each KPI conveys but also how to leverage this knowledge to your advantage.

You’ll walk away with:

A plan to upgrade your financial reports.

A video you can hand over to your bookkeeper to execute the plan.

Our CFO checklists so you can manage your numbers like a pro.

Investment: $0

In-Depth

If you are a business owner concerned about accuracy within your books. If you suspect that your current accountant or bookkeeper might not be meeting your business needs…

Our In-Depth Financial Analysis is going to cover that.

In addition to the free version, here's what we'll do for you:

-

We'll ensure that your financial data is error-free and consistent. We'll review:

All account reconciliations are comprehensive and current

Ensure coding entries are accurate and consistent

Check any items affecting financial reporting accuracy

Audit invoice feature and check register utilization

To identify common oversights in your accounting practices to ensure your books are clean.

In addition to the free version, you’ll walk away with:

A detailed presentation including a strategic roadmap to get your business where you want to be with a realistic timeline.

A comprehensive video you can hand over to your bookkeeper to execute the roadmap.

Investment: $525

Results

If you want to breathe easier knowing that your records are accurate and up-to-date, this thorough analysis will provide you with the confidence that all tasks are being carried out correctly.

Don't miss this opportunity to optimize your financial management. Take advantage of our Financial Analysis to ensure you're making informed financial decisions and maximizing your business's potential.

FAQs

-

Financial analysis is the assessment of a business's financial health, performance, and prospects through the examination of financial statements, ratios, and trends. It involves scrutinizing income statements, balance sheets, and cash flow statements to understand revenue generation, expense management, and cash flow dynamics. Key ratios, including profitability and leverage ratios, are calculated to evaluate operational efficiency and financial stability. We also identify trends and make comparisons over time or against industry benchmarks using tools like ratio analysis and trend analysis.

This process aids management in making informed decisions about the company's overall financial well-being. Financial analysis provides insights into strengths, weaknesses, and areas for improvement, supporting strategic decision-making for enhanced financial performance. In essence, it is a vital tool for understanding a company's financial position and informing key decisions in financial management and strategic planning.

This process aids management in making informed decisions about the company's overall financial well-being. Financial analysis provides insights into strengths, weaknesses, and areas for improvement, supporting strategic decision-making for enhanced financial performance. In essence, it is a vital tool for understanding a company's financial position and informing key decisions in financial management and strategic planning.

-

We are intimately familiar with the most effective ways to present financials, where the common mistakes happen, and how to correct them. Having insight from our team of experts will give you confidence in the accuracy of your books, and in understanding your financial reports so you can make informed business decisions.

-

We are not here to step on your current bookkeepers’ toes, we're here to partner with them. We recommend you give your bookkeeper a heads up that you are having this done and let them know it is not with the intention of replacing them. We partner with many bookkeepers while upholding the highest level of professional courtesy and respect. If your bookkeeper is doing a great job and is open to our recommendations, our advice is to keep that relationship if it's in your best interest. However, it's not uncommon for business owners to realize that their current bookkeeper is not the best fit for them after going through our analysis. In the end, you deserve the highest quality financial reporting and if a bookkeeper is not willing to be held accountable or is unable to grow with your business, it is your business who will suffer. You are the priority.

-

Our team is available to make all of the suggested upgrades to your financials, and we’ll make sure your bookkeeper understands how to maintain them once we’re done.

-

This is a one-time service that you can utilize at any time. Many businesses have us do this quarterly, bi-annually, or at the end of the year for their business. Our team is ready to help you implement the upgrades and committed to making sure your current bookkeeper understands what to do differently moving forward.

-

We take privacy and security very seriously. Our company platforms are consistently monitored by one of the legal industry’s best IT providers and use multi-layer security precautions. If you choose to engage in the upgraded financial analysis all of your login data is stored in LastPass, one of the most trusted password protection software.

-

We take privacy and security very seriously. Our company platforms are consistently monitored by one of the legal industry’s best IT providers and use multi-layer security precautions. If you choose to engage in the upgraded financial analysis there are two options: 1.) grant us access to your financials via Lawmatics or 2.) give us temporary access to your accounting software by making us a user.